Travelling Expenses Tax Deductible Malaysia 2020

If transport expenses are incurred for discharging official duties for example travelling from office to meet a client the reimbursements are not taxable.

Travelling expenses tax deductible malaysia 2020. Eligible expenses on qualifying activities outside the four areas and expenses exceeding s 150 000 will require enterprise singapore s approval. Examples of such entertainment expenses are expenditure incurred on samples of products of the business small souvenirs bags and travel tickets provided as gifts to customers or visitors at the trade fairs or trade exhibitions or industrial exhibitions held outside malaysia. Income tax exemptions of up to rm1 000 for local travel expenses will also be extended until the end of 2020. Special personal income tax relief for domestic travelling expenses it was announced in the economic stimulus package that a special personal income tax relief of up to rm1 000 be given to resident individuals for domestic traveling expenses incurred between 1 march 2020 to to 31 august 2020.

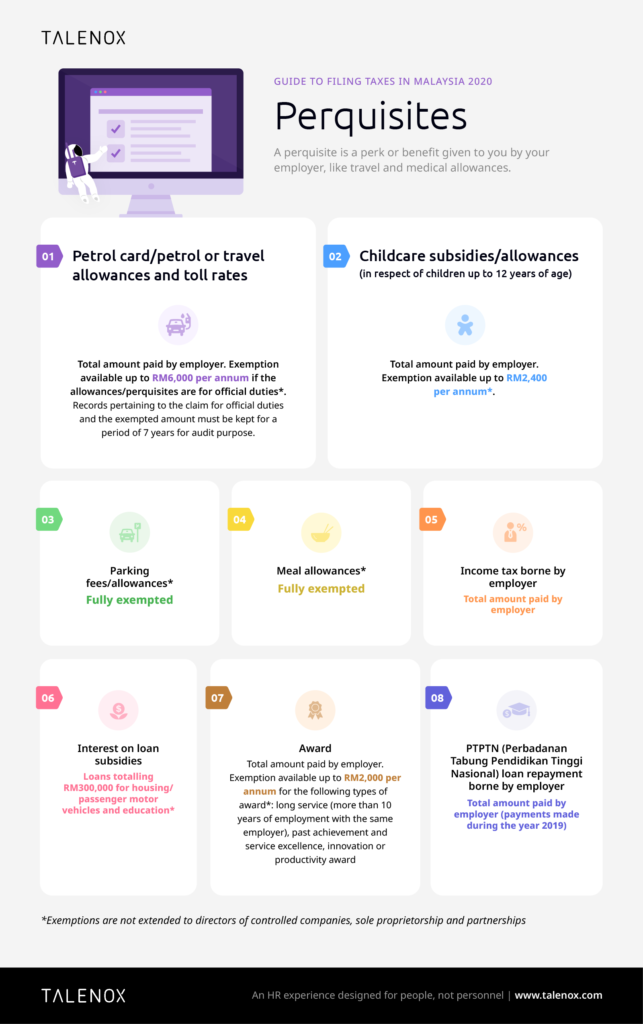

If the total amount of loan exceeds rm300 000 the amount of subsidized interest to be exempted from tax is limited in accordance with the following formula. This has now been extended. It is proposed that a special personal income tax relief of up to rm1 000 be given to resident individuals for domestic traveling expenses incurred between 1 march 2020 to 31 august 2020. Companies will need to apply to enterprise singapore for the enhancements announced during budget 2020.

External meeting place with clients external venue for trainings seminars workshops courses and retreats are also not taxable. This does not apply to the extended scope of eligible expenses announced during budget 2020. 2020 to 31 december 2020. Self spouse or child for treatment of a serious disease including medical examination fees subject to a limit of myr 500 or expenses incurred on fertility treatment with effect from ya 2020.

Parents for medical treatment special needs and carer expenses. When deductible they reduce your taxable income and the amount of tax you need to pay. Reliefs ya 2020 maximum myr medical expenses. Tax rebate for self if your chargeable income after tax reliefs and deductions does not exceed rm35 000 you will be granted a rebate of rm400 from your tax charged.

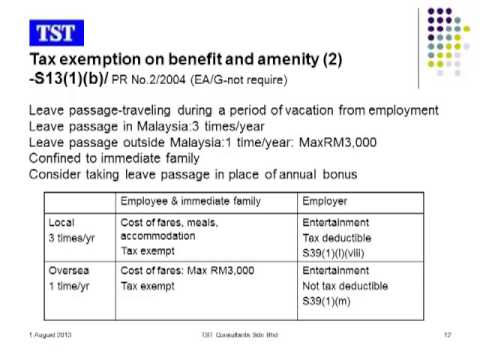

The expenses eligible for tax relief are as follows. Currently traveling expenses both local or overseas are not deductible against income chargeable to tax. Subsidised interest for housing education or car loan is fully exempted from tax if the total amount of loan taken in aggregate does not exceed rm300 000. Business expenses may be deductible or non deductible.

Some examples are cpf contributions wages renovation advertising etc. Business expenses are expenses you have paid to run the business.