Stamp Duty Calculation Malaysia For Transfer Of Shares

Book debts benefits to legal rights and goodwill.

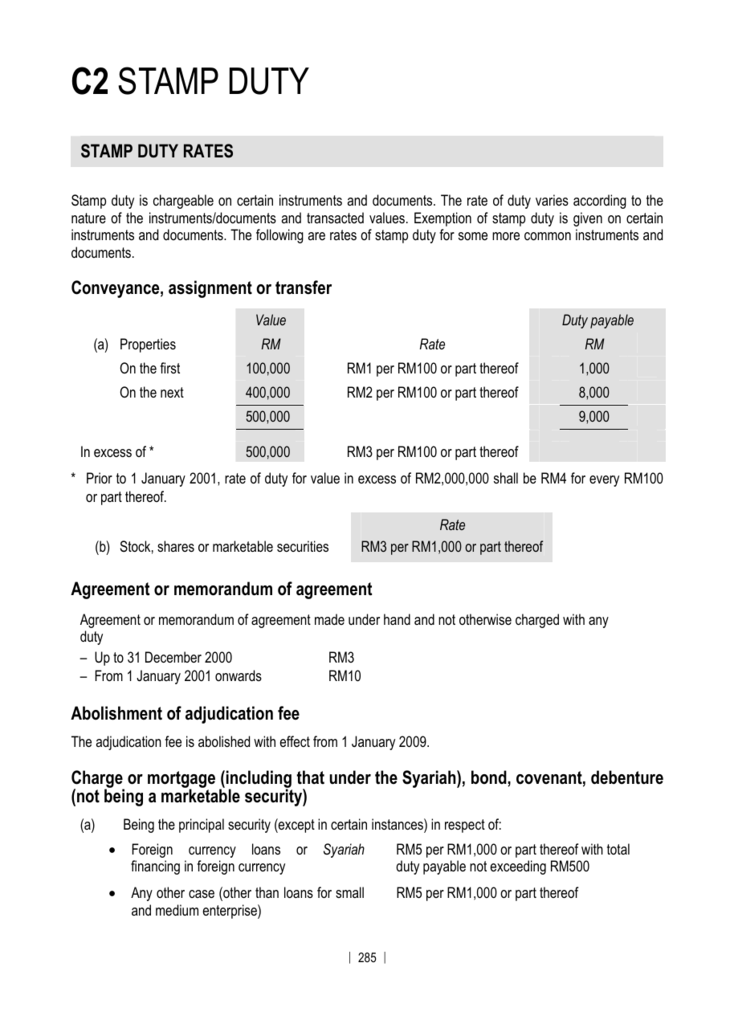

Stamp duty calculation malaysia for transfer of shares. The rate of stamp duty for all stocks shares or marketable securities is rm3 per rm1 000 or part therof. How to calculate the stamp duty for share transfer. Is there any indirect tax on transfer of shares stamp duty transfer tax etc. Contract or agreement e g.

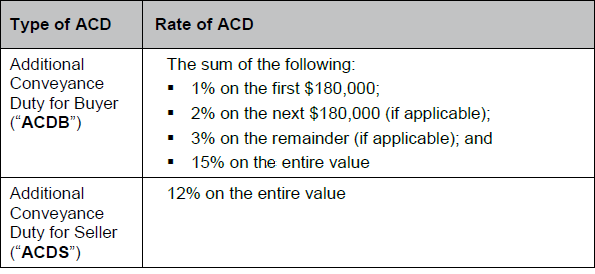

Form c s lite simplified tax return for companies with revenue 200 000 or below. Stamp duty exemption on perlindungan tenang insurance policies and takaful certificates with a yearly premium contribution not exceeding. Malaysia imposes stamp duty on chargeable instruments executed on certain transactions. The transfer of shares will attract stamp duty at the rate of 0 3 on the consideration paid or market value of the shares whichever is the higher.

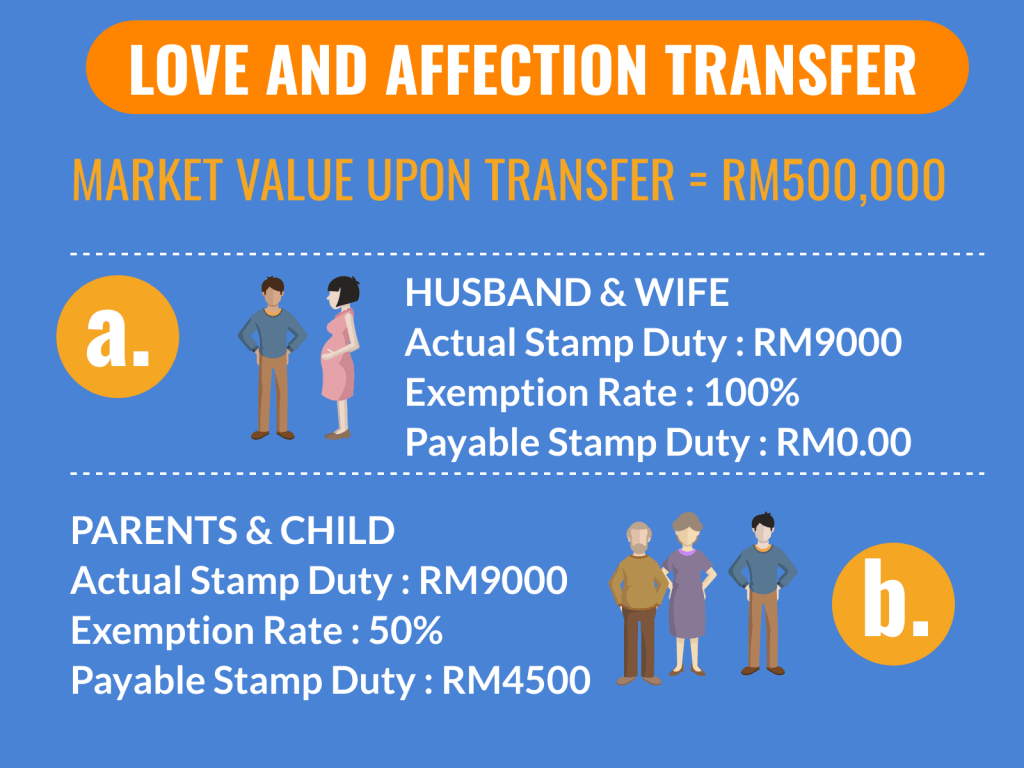

The stamp duty for sale and purchase agreements and loan agreements are determined by the stamp act 1949 and finance act 2018 the latest stamp duty scale will apply to loan agreements dated 1 january 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 july or later. The valuation of shares are normally calculated based on the following. The actual calculation of stamp duty is before first time house buyer stamp duty exemption rm450 000 x 0 50 rm2250 00 after first time house buyer stamp duty exemption. Filing estimated chargeable income eci and paying estimated taxes.

Sale and purchase agreement and transfer instruments for shares. Rm2250 rm1500 rm750 stamp duty to pay. The instruments of transfer on sale of any stock shares or marketable securities is subject to duty under item 32 b of the first schedule stamp act 1949 as follows. Stamp duty is payable on the actual price or net asset value of the shares whichever is higher.

Feel free to use our calculators below. Instruments of transfer implementing a sale or gift of property including marketable securities meaning loan stocks and shares of public companies listed on the bursa malaysia berhad shares of other companies and of non tangible property e g. Par value of the share normally is rm1 00 each shareholders fund in the audited accounts over the number of shares. Please contact us for a quotation for services required.

Stamp duty exemption on contract notes for sale and purchase transaction of shares of a medium and small capital company in bursa malaysia securities berhad executed from 1 march 2018 to 28 february 2021.