Green Investment Tax Allowance

Unutilised allowances can be carried forward until they are fully absorbed.

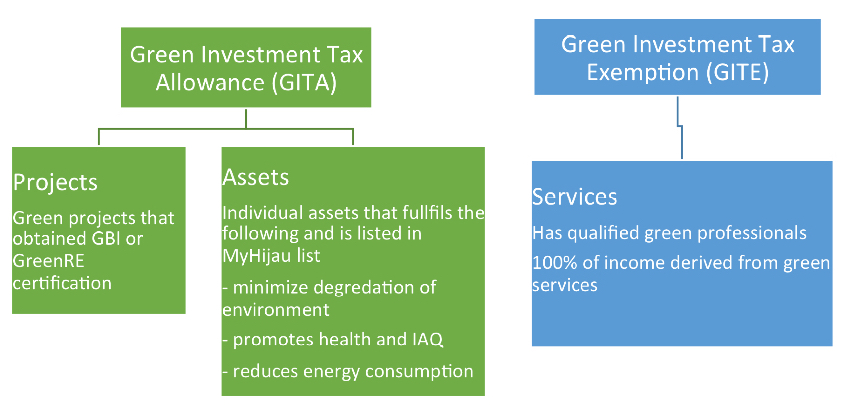

Green investment tax allowance. The malaysian government currently offers a 100 tax incentive known as green investment tax allowance gita and green investment tax exemption gite to encourage the use of eco and green technology products. The green investment tax allowance gita assets are for companies that obtained qualifying green technology assets. Buildings used solely for the purposes of such projects qualify for an industrial building allowance. Extension of green investment tax allowance gita green income tax exemption gite until 2023.

The allowance can be offset against 70 of statutory income in the year of assessment. The allowance can be offset against 100 of statutory income in the year of assessment. 5 0 green investment tax allowance gita project 15 5 1 features for gita project 15 5 2 list of qualifying activities 18 5 3 schematics of the application process 20 6 0 green income tax exemption gite services 22 6 1 features for gite services. For budget 2020 government announce that the green investment tax allowance gita and green income tax exemption gite incentives will be extended to 2023.

Green investment tax allowance gita of 100 of qualifying capital expenditure incurred on approved green technology assets from the date of purchase until 31 december 2020. î n w p î v s z ke µ ç î ì í õ 5 9 7 216 1 1 7 216 7kh deeuhyldwlrqv wkdw duh xvhg wkurxjkrxw wklv xlgholqh duh ghilqhg dv ehorz. To take advantage of this tax allowance companies should comply with all the following requirements. Investment allowance of 60 of qce incurred within five years to be utilised against 70 of statutory income or income tax exemption of 70 of statutory income for a period of five years.

Green technology financing scheme 2 0 gtfs 2 0. Unutilised allowances can be carried forward until they are fully absorbed. Under the provision of budget 2014 tax incentives for green technology in the form of green investment tax allowance ita for the purchase of green technology assets and income tax exemption ite on the use of green technology services and system were introduced to further strengthen the development of green technology.