Capital Allowance Rate Malaysia 2020

Restriction on deductibility of interest section 140c.

Capital allowance rate malaysia 2020. This change seeks to eliminate double incentivisation where the capital grants are not taxed while the expenditures funded by these grants are eligible for capital allowances. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. A capital allowance is an expenditure a british business may claim against its taxable profit under the capital allowances act. Return form rf filing programme for the year 2020 amendment 1 2020 return form rf filing programme for the year 2020 amendment 2 2020.

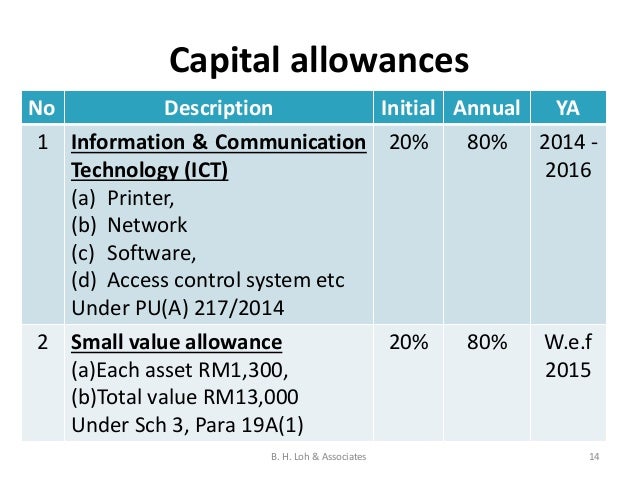

In total the capital allowance claim for ya 2020 will be 31 367 29 900 1 467. 5 2014 dated 27 june 2014. The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. Ownership of plant and machinery for the purpose of claiming capital allowances superceded by public ruling no.

100 capital allowance on that qualifying expenditure. Assuming that capital allowances are claimed over three years the capital allowances for ya 2020 for this asset will be 1 467 4 400 3 years. 2019 2020 malaysian tax booklet this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. 1 2020 22 05 2020 refer year 2020.

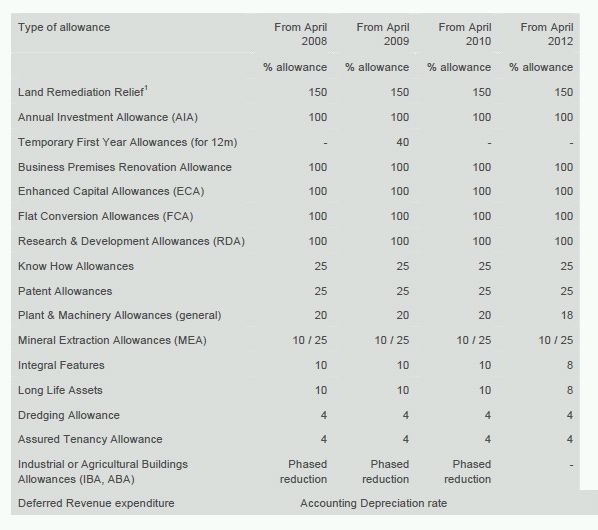

Writing down allowance rates. A new incentive has been proposed in the form of accelerated capital allowances and automation equipment allowances to encourage the transformation to industry 4 0 which involves the adoption of technology. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. As announced in budget 2020 capital allowances will no longer be given on expenditures funded by capital grants from the government or statutory boards that are approved on or after 1 jan 2021.

Average lending rate bank negara malaysia schedule section 140b. Average lending rate bank negara malaysia schedule section 140b. The tax deduction is. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

Restriction on deductibility. Billion for the tourism sector in connection with visit malaysia year 2020. Superceded by the public ruling no. As sme is subject to income tax at the rate of 17 on the first rm500 000 of chargeable income.